Organizational Structure

SAMPLE ORGANIZATIONAL STRUCTURES

An organizational structure consists of activities such as task

allocation, coordination and supervision, which are directed towards the

achievement of organizational aims. It can also be considered as the viewing glass or perspective through

which individuals see their organization and its environment.

Organizational structure affects organizational action in two big ways.

a) Provides the foundation on which standard operating procedures

and routines rest.

b) Determines which individuals get to

participate in which decision-making processes, and thus to what extent

their views shape the organization’s actions.

The set organizational structure may not coincide with facts, evolving

in operational action. Such divergence decreases performance, when

growing. E.g., a wrong organizational structure may hamper cooperation

and thus hinder the completion of orders in due time and within limits

of resources and budgets. Organizational structures shall be adaptive to

process requirements, aiming to optimize the ratio of effort and input

to output.

- 4 Basic Elements of Organizational Structure

a) Span of Control: Number of people directly reporting to the next level in the hierarchy.

b) Centralization: Degree to which formal decision authority is held be a small group of

people, typically those at the top of the organizational hierarchy.

c) Formalization: Degree to which organizations standardize behavior through rules,

procedures, formal training, and related mechanisms.

d) Departmentalization: Organizational charts that specifies how employees and their activities are grouped together.

- TYPES OF ORGANIZATIONAL STRUCTURES

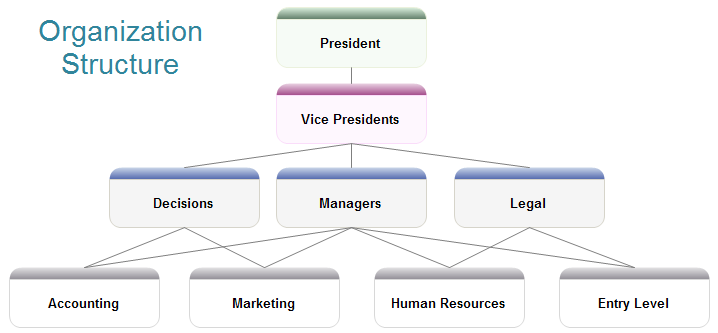

a) Functional Organization

This type of organizational structure:

- Brings together in one department everyone engaged in one activity or several related activities that are called FUNCTIONS.

For example: As shown, the organization is divided by functions into

different departments like sales, finance, engineering, HR. A sales

manager would be responsible for the sale of all the products which are

manufactured by the firm.

- This leads to operational efficiencies within that group. However it

could also lead to a lack of communication between the functional groups

within an organization, making the organization slow and inflexible.

- Mainly used by the smaller firms that offer a limited line of products.

- Makes supervision easier as each manager must be expert in

only a narrow range of skills. It also helps to group a particular set

of people with the specialized kind of skill set.

- But as the organization grow and diversify, some of the problems begin to surface:

i) As each department functional managers need to report to central

headquarters (President), it can be difficult to make quick decisions.

ii) Harder to judge performance because which department to blame when a new product fails.

iii) Difficult to coordinate the

functions of members of the entire organization as each department may

have difficulty working with other departments in a unified way to

achieve organizational goals.

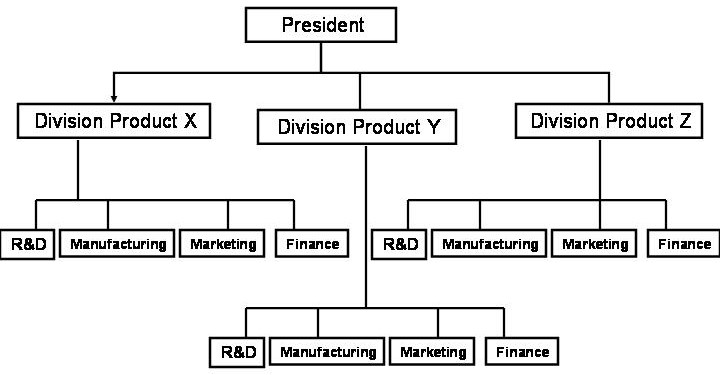

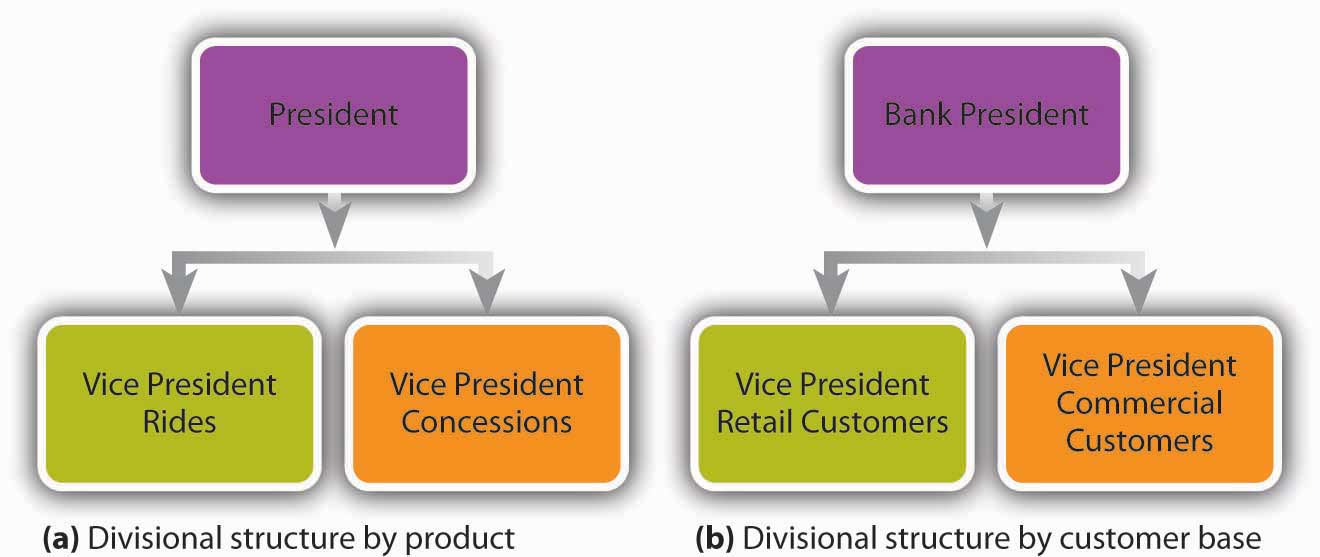

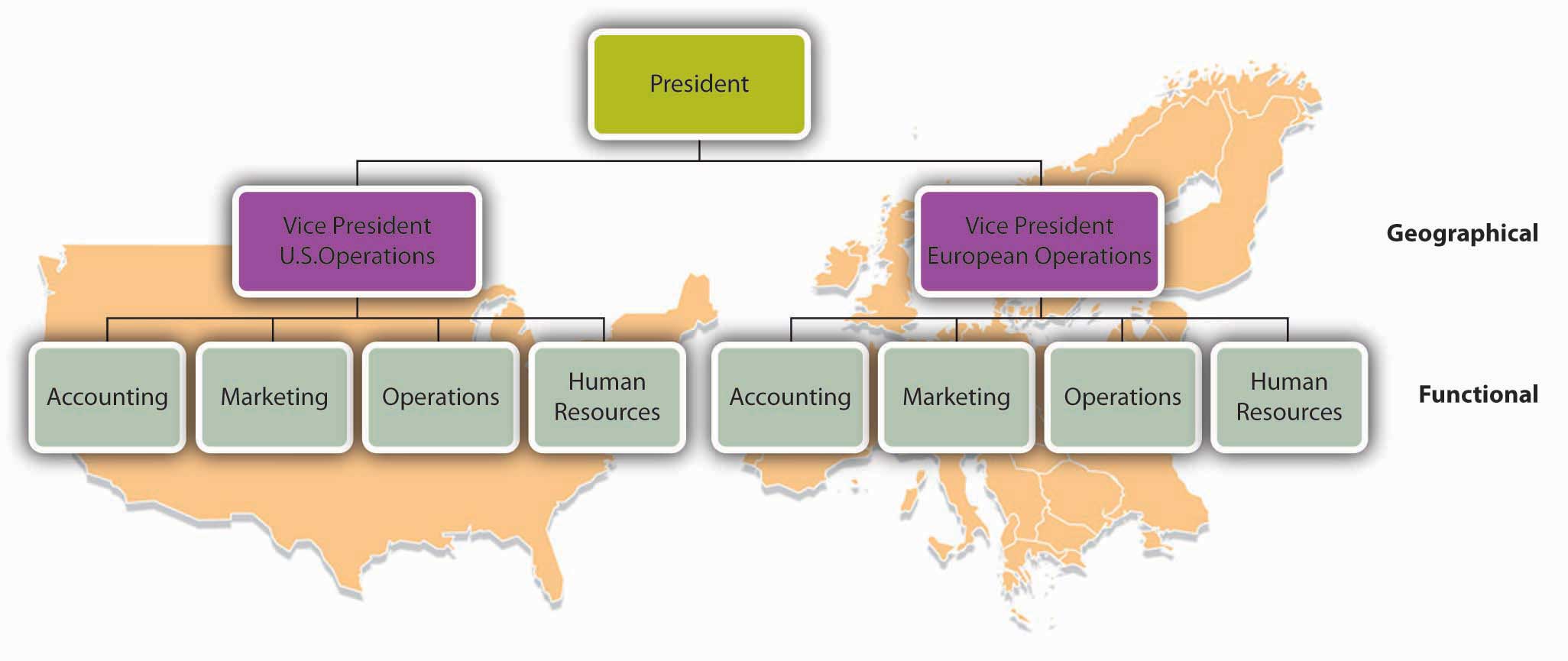

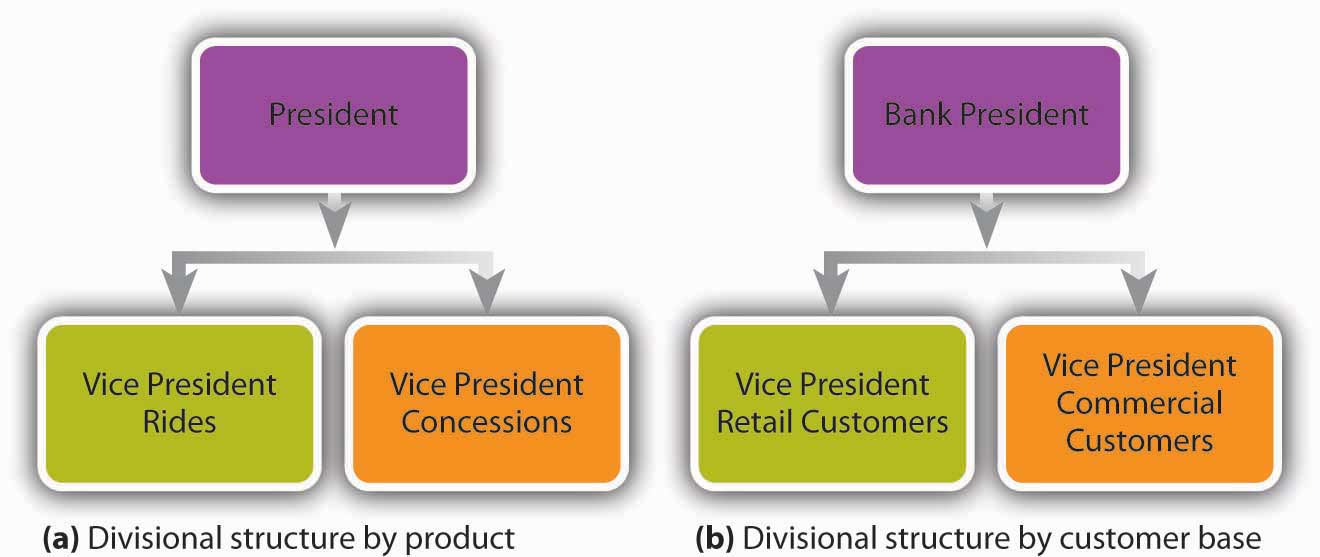

b) Product/Market/Divisional Organization

- Brings together in one work unit all

those involved in the production and marketing of a product or a related

group of products, all those in a certain geographic area, or all those dealing with a certain type of customer.

- Can follow three patterns as described above:

i) DIVISION BY PRODUCT

As shown the categorization (division) has

been done on the basis of broad category of products. And each category

of related group of products has its own marketing, sales, purchasing

and inventory manager.

ii) DIVISION BY GEOGRAPHY

Geographical organization is logical when a

plant must be located as close as possible to sources of raw materials,

to major markets, or to specialized personnel.

iii) DIVISION BY CUSTOMER

The organization is divided according to the different ways customers use products.

c) Matrix Organization/ Multiple Command System

- Employees have in effect 2 bosses ie. 2

chains of command. One chain of command is functional or divisional and

the second is a horizontal overlay that combines people from various

divisions or functional departments into a project or business team led

by a project or group manager who is an expert in the team's assigned

area of specialization.

- For example, many large companies have a corporate human resources

division, with individual HR representatives stationed at local

facilities. At the local level, the HR representative may report to the

operations manager charged with responsibility for that facility.

However, the operations manger does not likely have specific expertise

in human resource management and is not directly involved in setting

corporate HR initiatives. For that reason, the HR representative may

also report to a corporate HR manager or director, resulting is a matrix structure

- Bring together the diverse specialized skills required to solve a complex problem.

- Problems of coordination are minimized here because the most

important personnel for a project work together as a group. They come to

understand the demands faced by those who have different areas of

responsibility.

- Gives the organization a great deal of cost-saving flexibility

because each project is assigned only to the required people and

unnecessary duplication is avoided.

- To be effective, team members must have good interpersonal skills and flexibility and cooperation.

A tall organization is quite hierarchical, with several different levels of management. Individual managers have a narrow span of control, with a relatively small number of employees in their direct reporting line. Decision making tends to be centralized with management in tall organizations.

A flat organization is one where there are relatively few levels of management. Supervisory employees tend to have a wide span of control, which means they are likely to have a relatively large number of direct reports. Decision making is less centralized, with employees being empowered to exercise discretion in their work and having an opportunity to participate in much of the decision making that takes place.

- Additional Business Structure Considerations: Flat vs. Tall

In addition to defining the reporting structure, businesses structures can also be described in terms of whether the organization is tall or flat. This characteristic refers to how many layers of management there are in an organization.A tall organization is quite hierarchical, with several different levels of management. Individual managers have a narrow span of control, with a relatively small number of employees in their direct reporting line. Decision making tends to be centralized with management in tall organizations.

A flat organization is one where there are relatively few levels of management. Supervisory employees tend to have a wide span of control, which means they are likely to have a relatively large number of direct reports. Decision making is less centralized, with employees being empowered to exercise discretion in their work and having an opportunity to participate in much of the decision making that takes place.